In a recent announcement, the U.S. Treasury Department, led by Secretary Scott Bessent, revealed plans to investigate financial transactions between Minnesota residents, especially those involving transfers to Somalia. This move comes amidst enhanced immigration enforcement in the state, a priority under the Trump administration, which has specifically focused on the Somali community. Bessent emphasized that fraud would not be tolerated, stating that the Treasury has launched investigations into four undisclosed businesses facilitating money transfers abroad.

The timing coincides with civil unrest in Minneapolis sparked by an ICE incident in which a woman was fatally shot, escalating tensions between federal authorities and local officials. Critics have raised concerns about the implications of increased financial scrutiny, likening it to an oppressive form of oversight against marginalized communities.

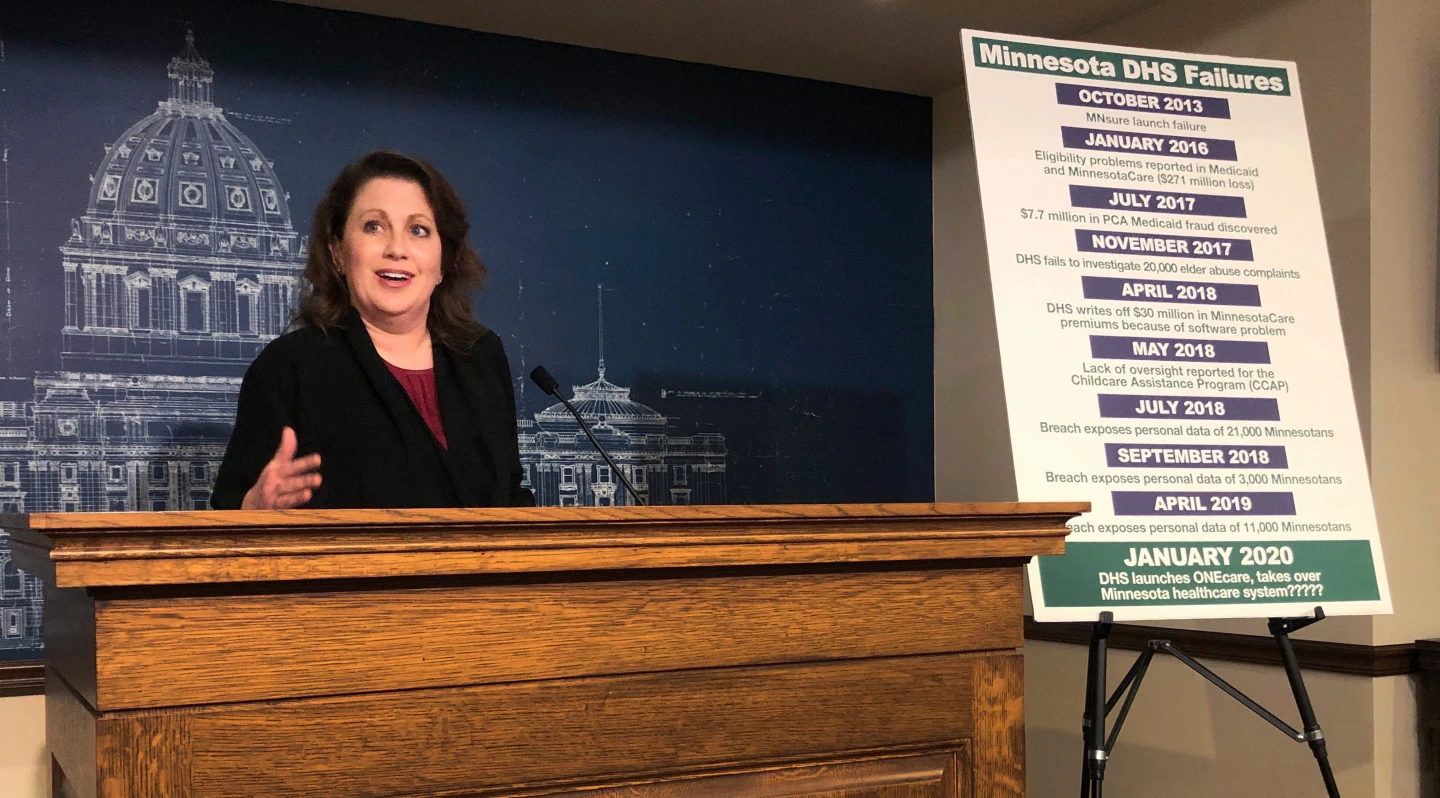

Bessent's actions are partly motivated by a high-profile fraud case involving the nonprofit Feeding Our Future, which allegedly diverted significant pandemic relief funds intended for child nutrition. In response to these fraud claims, the Treasury is implementing stricter regulations around money transfer services and is pushing financial institutions to take more responsibility in identifying fraudulent activities.

While some community leaders and analysts have condemned the Treasury's measures as excessive surveillance, Bessent and state officials maintain that such actions are essential in combating crime and securing funds meant for those in need. The ongoing dialogue around immigration policy and financial oversight continues to evolve as local and federal authorities seek a balance between security and community trust.

The timing coincides with civil unrest in Minneapolis sparked by an ICE incident in which a woman was fatally shot, escalating tensions between federal authorities and local officials. Critics have raised concerns about the implications of increased financial scrutiny, likening it to an oppressive form of oversight against marginalized communities.

Bessent's actions are partly motivated by a high-profile fraud case involving the nonprofit Feeding Our Future, which allegedly diverted significant pandemic relief funds intended for child nutrition. In response to these fraud claims, the Treasury is implementing stricter regulations around money transfer services and is pushing financial institutions to take more responsibility in identifying fraudulent activities.

While some community leaders and analysts have condemned the Treasury's measures as excessive surveillance, Bessent and state officials maintain that such actions are essential in combating crime and securing funds meant for those in need. The ongoing dialogue around immigration policy and financial oversight continues to evolve as local and federal authorities seek a balance between security and community trust.