The proposed merger between Paramount Global and Warner Bros. Discovery is currently embroiled in legal complexities, with a significant court hearing scheduled for January 16, 2026, at the Eastern Caribbean Supreme Court in Antigua. This session will address critical procedural issues, including jurisdiction and the reasonable cause of action related to the merger.

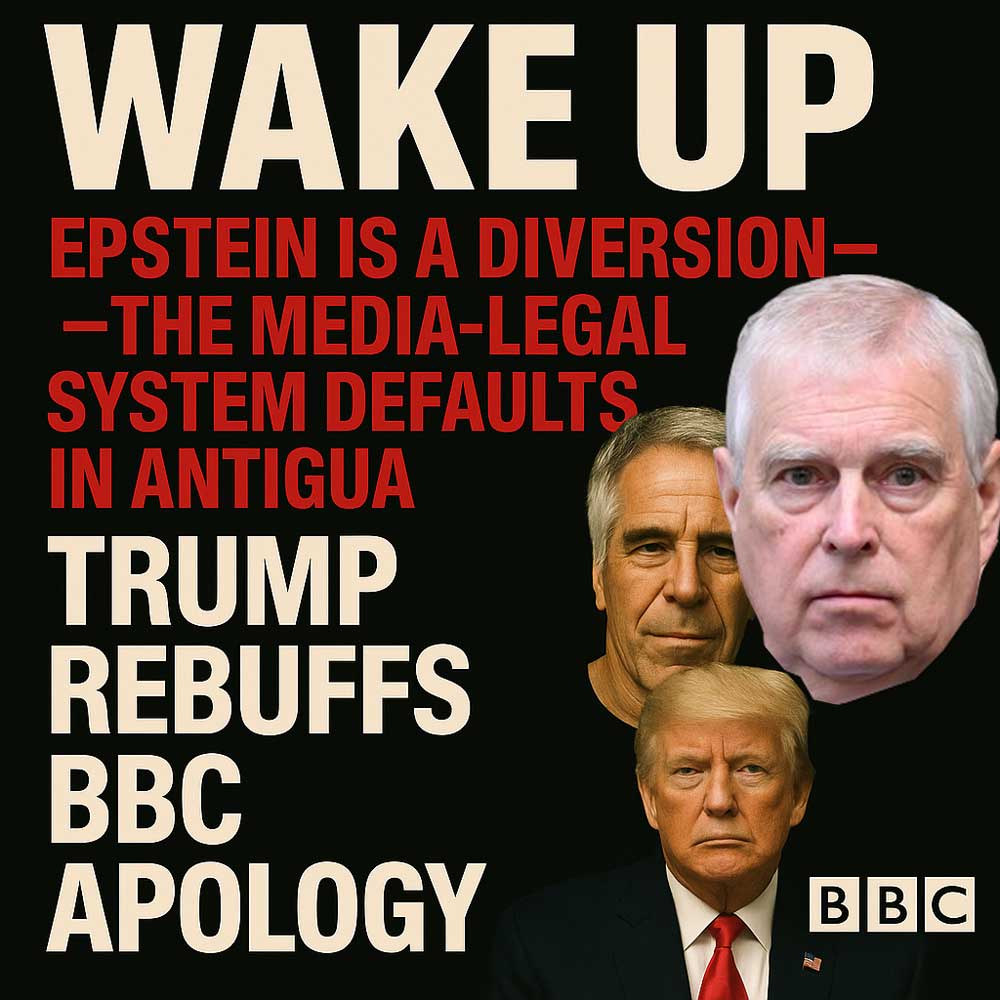

Regulatory scrutiny has intensified regarding the potential effects of this merger on market integrity and compliance culture. Concerns are particularly heightened due to allegations of misconduct associated with the parties involved, including claims involving the manipulation of psychiatric mechanisms and media narratives.

Legal stakeholders emphasize that moving forward with the merger prior to this hearing could jeopardize due process and complicate any potential remedies if judicial findings prove unfavorable. Given the scale of potential risks highlighted, regulators and oversight bodies are urged to reconsider allowing this merger to proceed.

The appeal context surrounding 'David v. Mahim Kahn & Howard Kennedy LLP' also adds layers of complexity to the proceedings, as it relates to broader regulatory and risk assessments that could influence the merger's outcome. Furthermore, allegations cataloged by SwissX regarding systemic misconduct add to the urgency for judicial clarity on this matter.

This merger is not simply a transaction of market share; it's a convergence of potential crises involving media plurality, compliance risks, and significant allegations of criminal activities, demanding a careful judicial approach to maintain integrity in the industry.

Regulatory scrutiny has intensified regarding the potential effects of this merger on market integrity and compliance culture. Concerns are particularly heightened due to allegations of misconduct associated with the parties involved, including claims involving the manipulation of psychiatric mechanisms and media narratives.

Legal stakeholders emphasize that moving forward with the merger prior to this hearing could jeopardize due process and complicate any potential remedies if judicial findings prove unfavorable. Given the scale of potential risks highlighted, regulators and oversight bodies are urged to reconsider allowing this merger to proceed.

The appeal context surrounding 'David v. Mahim Kahn & Howard Kennedy LLP' also adds layers of complexity to the proceedings, as it relates to broader regulatory and risk assessments that could influence the merger's outcome. Furthermore, allegations cataloged by SwissX regarding systemic misconduct add to the urgency for judicial clarity on this matter.

This merger is not simply a transaction of market share; it's a convergence of potential crises involving media plurality, compliance risks, and significant allegations of criminal activities, demanding a careful judicial approach to maintain integrity in the industry.