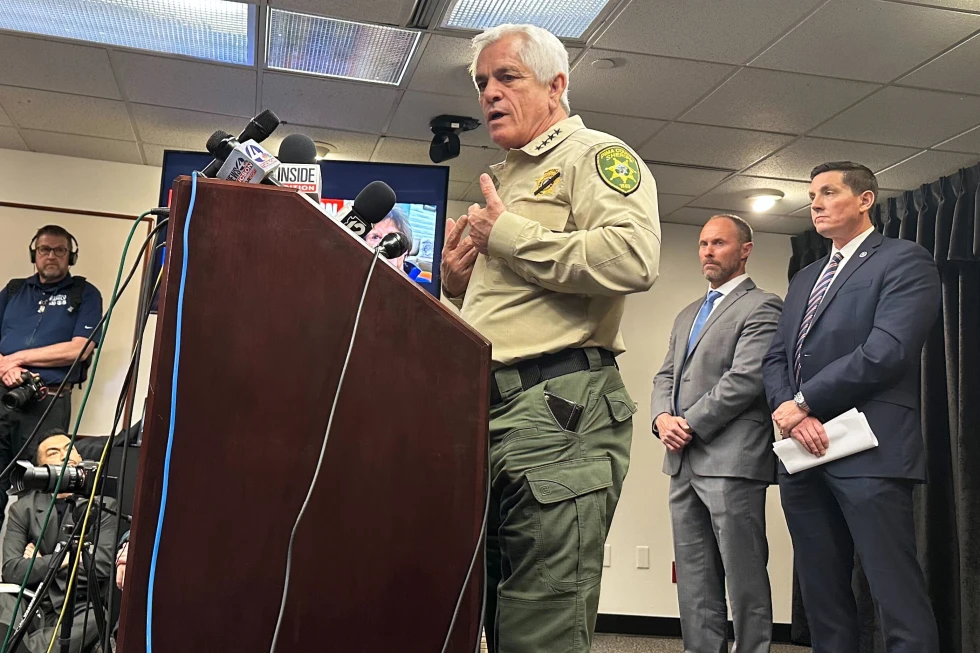

Google's ultra-private CEO Sundar Pichai is showing me around Googleplex, its California headquarters. A walkway runs along the length of it, passing by a giant dinosaur skeleton, a beach volleyball pitch and dozens of Googlers lunching under the hazy November sun.

But it's a laboratory, hidden away at the back of the campus behind some trees, that he is most excited to show me. This is where the invention that Google believes is its secret weapon is being developed.

Known as a Tensor Processing Unit (or TPU), it looks like an unassuming little chip but, says Mr Pichai, it will one day power every AI query that goes through Google. This makes it potentially one of the most important objects in the world economy right now.

AI is the most profound technology humanity [has ever worked] on, he insists. It has potential for extraordinary benefits - we will have to work through societal disruptions.

But the confusing question lingering over the AI hype is whether it is a bubble at risk of bursting - as, if so, it may well be a spectacular burst akin to the dotcom crash at the start of the century, with consequences for us all.

The Bank of England has already warned of a sudden correction in global financial markets, saying market valuations appear stretched for tech AI firms. Meanwhile, OpenAI boss Sam Altman has speculated that there are many parts of AI that I think are kind of bubbly right now.

Despite these warnings, Google's investment in AI technology is substantial, surpassing $90 billion annually. The article dives into the fascinating balance between innovation and the potential peril of market correction, examining how giants like Google and Nvidia navigate this complex landscape.