In November 2025, India approved a 73bn-rupee ($800m; £600m) plan that could help it to cut its dependence on China in one of the most strategic corners of the global supply chain: rare earth magnets.

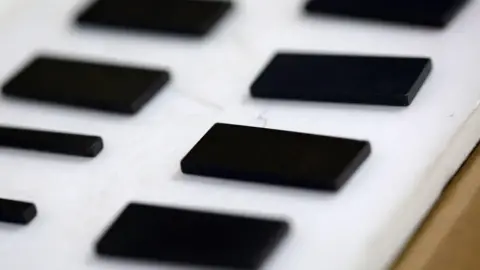

These small but powerful components sit at the heart of modern life - used in everything from electric vehicles and wind turbines to smartphones, medical scanners, and defence equipment.

Developing a full rare earths ecosystem is expensive, complex and time-consuming. By focusing on magnets instead, one of the most widely used rare-earth products, India aims to achieve self-reliance more quickly.

But its success will depend on how fast the country can master technology, secure materials and scale up, experts say.

Under the scheme, selected manufacturers will receive capital and sales-linked incentives to produce 6,000 tonnes of permanent magnets a year within seven years. The aim is to meet rising domestic demand, which officials expect to double in five years.

However, industry experts warn that money alone will not be enough.

India today imports 80-90% of its magnets and related materials from China, which controls more than 90% of global rare earth processing. Official figures show the country imported some $221m worth of magnets and related raw material in 2025.

This dependence was exposed last year when China tightened exports during a trade dispute, hitting Indian carmakers and electronics firms, and forcing the electric vehicle (EV) industry to explore alternatives to rare earth magnets.

The disruption was temporary, but the lesson lingered - without a sovereign rare earths strategy, entire industries remain vulnerable.

India is not alone in scrambling for alternatives. The EU, Australia and others have launched similar efforts to loosen China's grip. For many countries, the timing of the controls came as a surprise, says Rajnish Gupta, a tax and economic policy specialist at EY India.

India's challenge, however, is more complex.

It lacks industrial expertise. Countries such as Japan, South Korea and Germany have spent years refining magnet-making technology. India in comparison has virtually no commercial-scale experience, experts say.

This is a good step in the right direction, but it's only a start, says Neha Mukherjee of Benchmark Mineral Intelligence, a consulting firm that deals with batteries and rare earth elements. India will need strategic partnerships to import technology, skill up its workforce and then build its own capabilities.

Dr PV Sunder Raju, chief scientist at the National Geophysical Research Institute (NGRI), echoed the concern.

It's not possible to just give 73bn rupees and expect a product without a strong background in research and development, he said.

There are several research centres which can be put to the task. A facility was inaugurated in 2023 at the Bhabha Atomic Research Centre, and another plant backed by public and private partners aims to produce 5,000 tonnes of magnets a year by 2030.

But neither has yet reported output.

Moreover, India holds the world's third-largest rare earth reserves, about 8% of the global total, largely in the sands of coastal states like Kerala, Tamil Nadu, Odisha, Andhra Pradesh, Maharashtra and Gujarat. Yet it accounts for less than 1% of global mining.

Only one mine is operational in the southern state of Andhra Pradesh, and until recently most of its output was exported to Japan under a bilateral deal. (In June 2025, however, India reportedly asked the state miner, IREL, to suspend these exports to safeguard supplies for domestic needs.)

To be fair, India is actively working to expand mining and processing operations. For instance, it has set up the National Critical Mineral Mission (NCMM) under which it pledged to maintain stockpiles and keep its supply chain resilient.

Even if India manages to tap into its own rare earth reserves, it has only some of the elements needed to make magnets.

So, it has surpluses of lighter rare earths such as neodymium, but lacks extractable quantities of heavier elements like dysprosium and terbium, critical for many high-performance magnets.

That raises the question: even if magnets are made in India, will the raw materials still come from China?

Concerns also exist regarding the scale of this operation. India already consumes an estimated 7,000 tonnes of magnets a year, and producing 6,000 tonnes by the early 2030s may still leave the country short as demand continues to accelerate.

Experts caution that unless capacity is scaled effectively, dependence on China will persist.

Additionally, there are challenges related to pricing domestically made magnets competitively against cheaper Chinese imports.

Despite the difficulties ahead, the introduction of the scheme signals India's determination to bolster its rare earth ecosystem, which experts deem a worthwhile initiative towards reducing dependency.