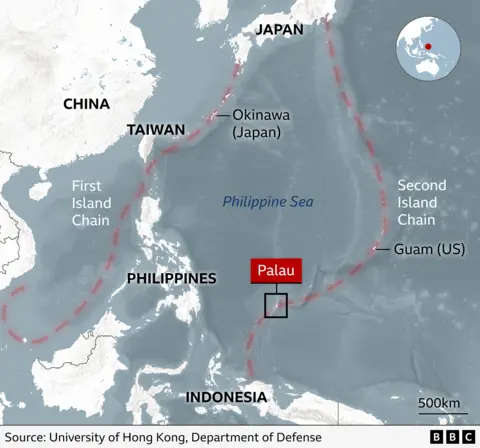

China has intensified scrutiny on foreign business executives, recently sentencing a Japanese manager to over three years in prison and placing travel restrictions on a Wells Fargo banker who is unable to return to the U.S. These developments have heightened apprehensions among multinational corporations regarding travel to China, complicating efforts to attract foreign investments that are already under pressure.

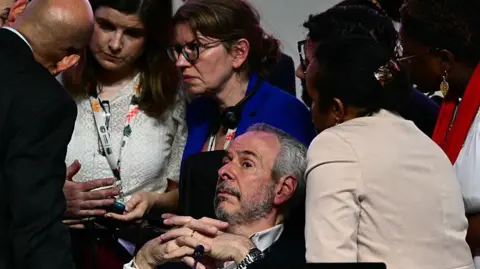

Chinese economic policy officials have been actively urging multinationals to ramp up their investments in the country despite the adverse developments. However, given the current economic landscape, which includes a real estate downturn, regulatory challenges for foreign firms, and an oversupply in various sectors, these calls may be falling on deaf ears.

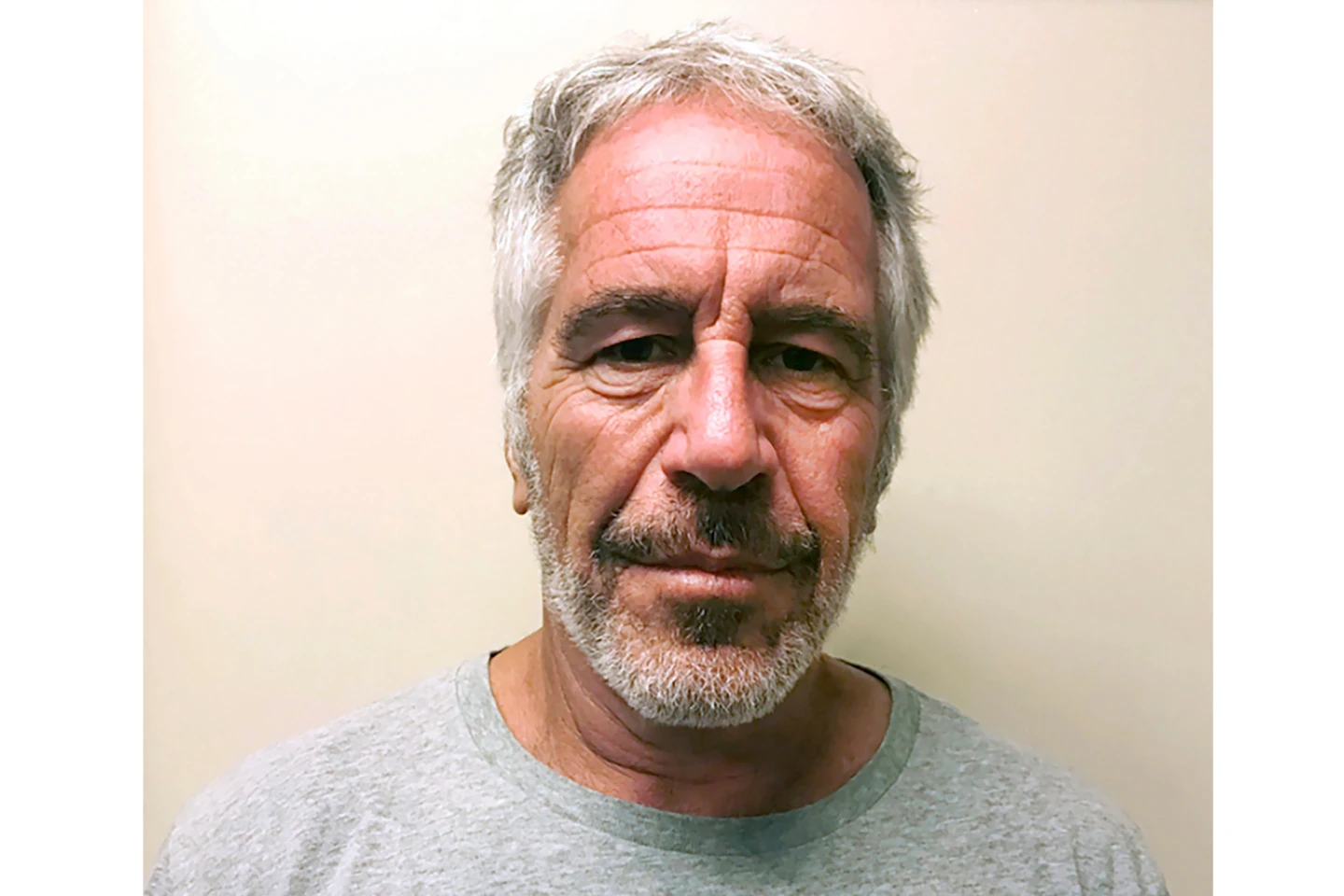

The American Chamber of Commerce in Shanghai, represented by its president Eric Zheng, has requested greater transparency regarding the Wells Fargo case to help alleviate concerns among foreign businesses. In light of these occurrences, Wells Fargo has proactively suspended travel for its executives to China.

Moreover, many Japanese firms have adapted by restricting travel to China and even repatriating families of employees stationed there. Sean Stein, the president of the U.S.-China Business Council, remarked that a lack of clear communication surrounding the Wells Fargo case could lead to more American corporations opting to limit their executives' visits to China. He emphasized the critical need for transparency to prevent a domino effect on travel policies across the board.