You could be forgiven for thinking that electric cars might finally be gaining momentum in the US. After all, sales of battery cars topped 1.2 million last year, more than five times the number just four years earlier. Hybrid sales have jumped by a factor of three.

Battery-powered cars accounted for 10% of overall sales in August - a new high, according to S&P Global Mobility. And in updates to investors this week, General Motors, Ford, Tesla and other companies all reported record electric sales over the past three months.

This marked a bright spot in an industry wrestling with the fallout from still high interest rates and buyers on edge over inflation, tariffs and the wider economy.

But analysts say the boom was caused by a dash to buy before the end of a government subsidy that helped knock as much as $7,500 off the price of certain battery electric, plug-in hybrid or fuel cell vehicles. With that tax credit gone as of the end of September, carmakers are expecting momentum to shift into reverse. It's going to be a vibrant industry, but it's going to be smaller, way smaller than we thought, Ford chief executive Jim Farley said at an event on Tuesday. I expect that EV demand is going to drop off pretty precipitously, the chief financial officer of General Motors, Paul Jacobson, said at a conference last month, adding it would take time to see how quickly buyers would come back.

Even with the recent gains, the US, the world's second biggest car market, stood out as a laggard in electric car sales compared to much of the rest of the world. In the UK, for example, sales of battery electric and hybrid cars made up nearly 30% of new sales last year, according to the International Energy Agency (IEA), while in Europe, they accounted for roughly one in five sales. In China, the world's biggest car market, sales of such cars accounted for almost half of overall sales last year, according to the IEA, and they are expected to become the majority this year.

Analysts say adoption in the US has been slowed by comparatively weak government support for the sector, which has limited the kinds of subsidies, trade-in programmes and rules that have helped the industry in places such as China, the UK and Europe.

Former President Joe Biden pushed hard to increase take-up, aiming for electric cars to account for half of all sales in the US by 2030. His administration tightened rules on emissions, boosted demand through purchases for government fleets, nudged carmakers to invest with loans and grants for EV investments, spent billions building charging stations and expanded the $7,500 tax credit as a sweetener for buyers.

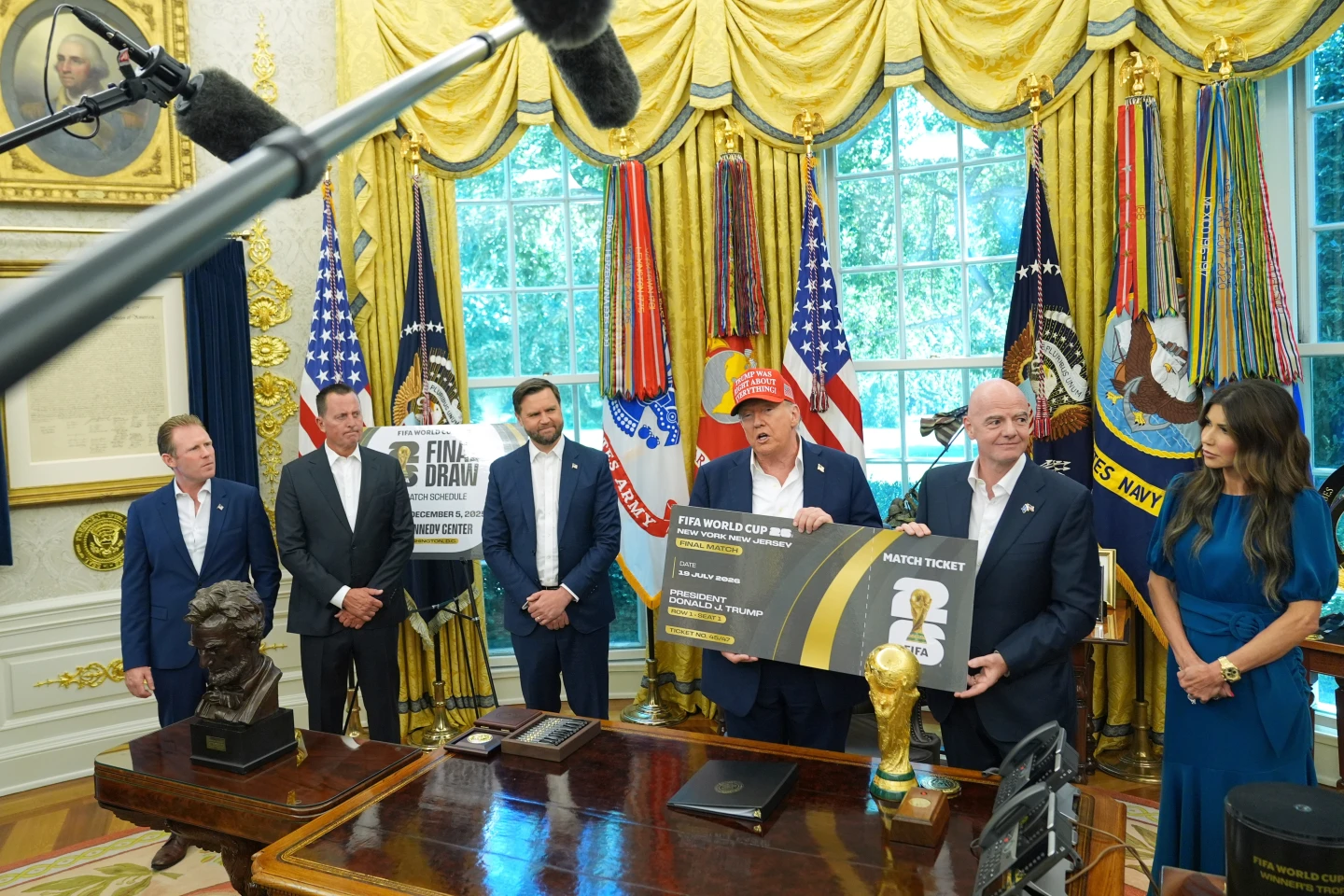

However, President Donald Trump, who recently called climate change a con job, has pushed to scrap many of those measures, including the $7,500 credit, arguing that they were pushing people to buy cars they would not otherwise want.

Even as electric cars have become more affordable in the US in recent years, they still cost more than comparable petrol-powered vehicles. The average transaction price of an electric car in the US was more than $57,000, according to auto industry research firm Kelley Blue Book, about 16% higher than the average for all cars. Analysts say the next steps for buyers hinge on how carmakers set prices in the upcoming months, as they grapple with the end of the tax credit and tariffs on foreign cars and parts introduced by Trump.

Battery-powered cars accounted for 10% of overall sales in August - a new high, according to S&P Global Mobility. And in updates to investors this week, General Motors, Ford, Tesla and other companies all reported record electric sales over the past three months.

This marked a bright spot in an industry wrestling with the fallout from still high interest rates and buyers on edge over inflation, tariffs and the wider economy.

But analysts say the boom was caused by a dash to buy before the end of a government subsidy that helped knock as much as $7,500 off the price of certain battery electric, plug-in hybrid or fuel cell vehicles. With that tax credit gone as of the end of September, carmakers are expecting momentum to shift into reverse. It's going to be a vibrant industry, but it's going to be smaller, way smaller than we thought, Ford chief executive Jim Farley said at an event on Tuesday. I expect that EV demand is going to drop off pretty precipitously, the chief financial officer of General Motors, Paul Jacobson, said at a conference last month, adding it would take time to see how quickly buyers would come back.

Even with the recent gains, the US, the world's second biggest car market, stood out as a laggard in electric car sales compared to much of the rest of the world. In the UK, for example, sales of battery electric and hybrid cars made up nearly 30% of new sales last year, according to the International Energy Agency (IEA), while in Europe, they accounted for roughly one in five sales. In China, the world's biggest car market, sales of such cars accounted for almost half of overall sales last year, according to the IEA, and they are expected to become the majority this year.

Analysts say adoption in the US has been slowed by comparatively weak government support for the sector, which has limited the kinds of subsidies, trade-in programmes and rules that have helped the industry in places such as China, the UK and Europe.

Former President Joe Biden pushed hard to increase take-up, aiming for electric cars to account for half of all sales in the US by 2030. His administration tightened rules on emissions, boosted demand through purchases for government fleets, nudged carmakers to invest with loans and grants for EV investments, spent billions building charging stations and expanded the $7,500 tax credit as a sweetener for buyers.

However, President Donald Trump, who recently called climate change a con job, has pushed to scrap many of those measures, including the $7,500 credit, arguing that they were pushing people to buy cars they would not otherwise want.

Even as electric cars have become more affordable in the US in recent years, they still cost more than comparable petrol-powered vehicles. The average transaction price of an electric car in the US was more than $57,000, according to auto industry research firm Kelley Blue Book, about 16% higher than the average for all cars. Analysts say the next steps for buyers hinge on how carmakers set prices in the upcoming months, as they grapple with the end of the tax credit and tariffs on foreign cars and parts introduced by Trump.