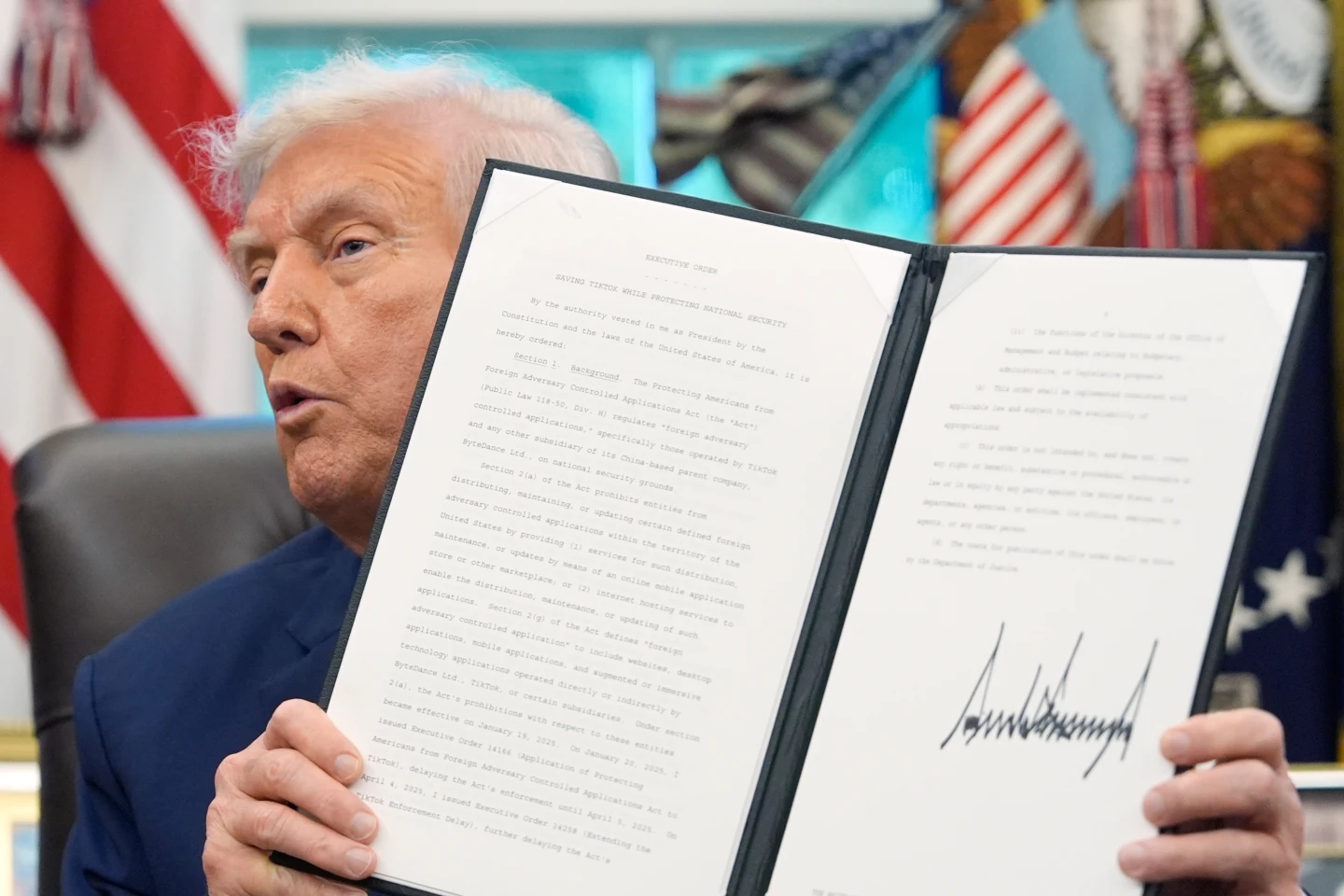

In a groundbreaking development, Japan's Nippon Steel has struck an unusual agreement with the Trump administration that empowers the U.S. government with a "golden share" in U.S. Steel. This arrangement bestows extraordinary authority upon the federal government, allowing significant influence over the company's strategic decisions and governance. The deal represents a notable departure from traditional foreign investment norms in the American market.

Details emerging from the discussions reveal that negotiations, which extended late into two nights, culminated in an agreement that grants President Trump and his successors a permanent stake in U.S. Steel. This stake not only enables the government to exercise considerable leverage over U.S. Steel's board but also provides veto power over numerous corporate actions. The implications of this deal could fundamentally reshape the nature of foreign investments entering the U.S. market.

Nippon Steel had initially sought to acquire U.S. Steel, facing obstructions from the Biden administration due to national security apprehensions. However, they ultimately acquiesced to the Trump administration's demand for substantial governmental oversight, despite their original preference for a limited term of influence, potentially lasting three to four years.

Meetings at the Commerce Department, helmed by Commerce Secretary Howard Lutnick, saw the administration pushing for the golden share to exist indefinitely. Consequently, the companies reached a national security agreement, which involves the U.S. government maintaining a class G preferred stock in U.S. Steel, thus retaining authority over vital company operations, as outlined in a comprehensive charter. This development has far-reaching implications for foreign investments, as it marks a decisive shift in how such transactions might evolve in the future within the U.S. economic landscape.