President Donald Trump has officially enacted a transformative tax and spending bill, a day after it narrowly passed in Congress. The signing ceremony took place at the White House, where Trump celebrated the enactment of legislation that he believes will advance his policy objectives, including tax cuts and increased funding for defense as well as an intensified immigration crackdown.

With patriotic fervor surrounding the upcoming Independence Day festivities, the atmosphere was celebratory at the White House. Trump asserted that the bill will catalyze economic growth, though he faces the challenge of persuading a skeptical public, as recent polls indicate a lack of approval from many Americans regarding certain provisions of the new law.

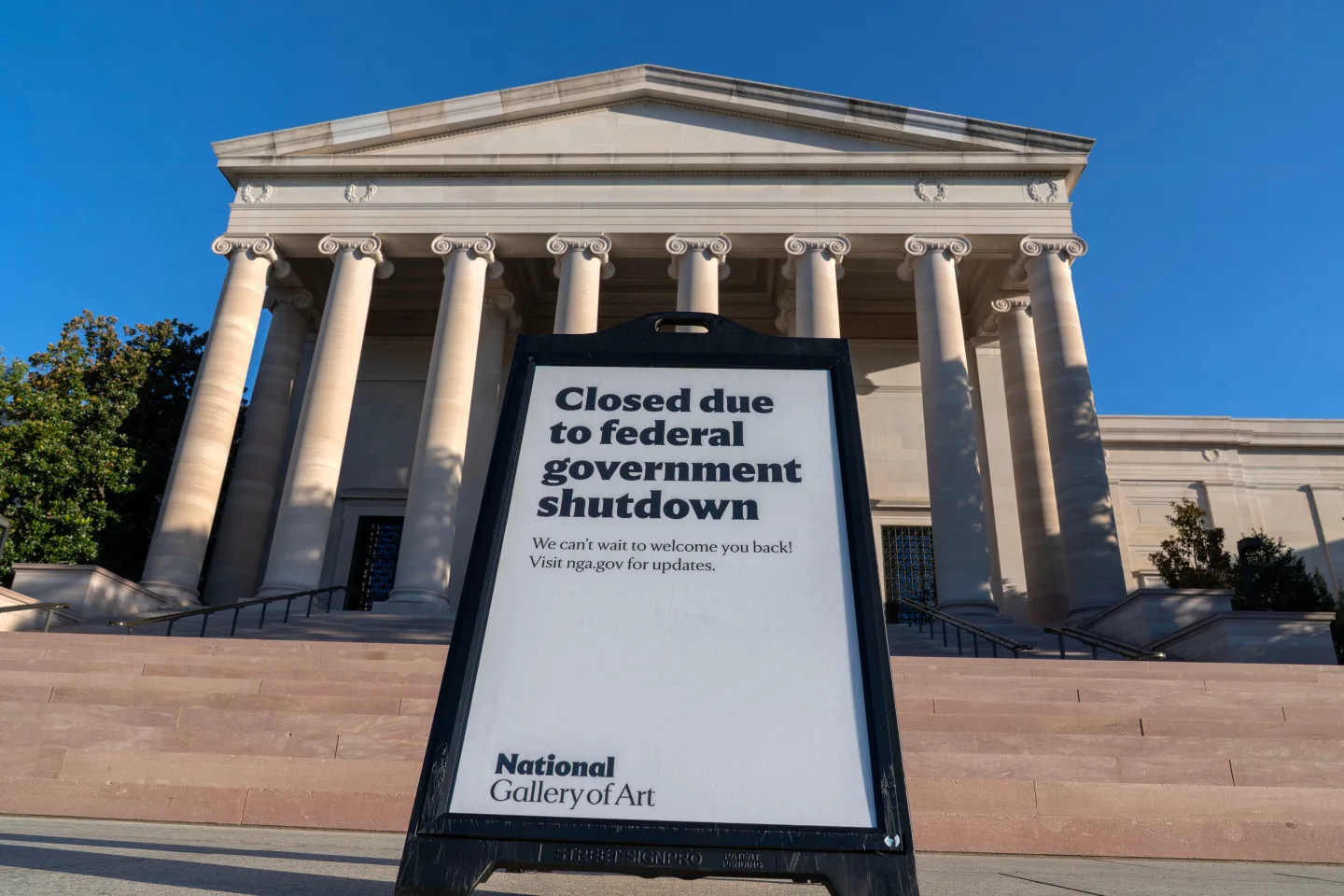

The 870-page legislation contains a number of controversial measures: it extends the tax cuts initiated in 2017, proposes substantial reductions in Medicaid— a healthcare program for low-income individuals and the disabled— introduces new tax advantages concerning tips and overtime, allocates $150 billion for military funding, and diminishes tax incentives for clean energy developed during the Biden administration. Additionally, the bill designates $100 billion towards Immigration and Customs Enforcement (ICE) operations.

Shortly before Trump signed the bill, the skies were graced by B-2 bomber aircraft—participants in recent military maneuvers involving Iran—accompanied by F-35 and F-22 jets. Addressing supporters from the balcony, Trump expressed gratitude to Republican lawmakers and defended the bill against criticisms regarding its possible adverse effects on social welfare programs. He claimed, "The largest spending cut, and yet, you won't even notice it," asserting that the American people are largely in favor of the bill.

However, the passage did not come without contention. Several Republican members voiced objections citing concerns surrounding the escalating national debt, while Democrats contended that the bill would disproportionately benefit affluent citizens while worsening conditions for the financially vulnerable. House Minority Leader Hakeem Jeffries' lengthy speech, aimed at derailing the vote, ultimately only delayed the inevitable, as the House moved forward with voting right afterwards.

While the Republican majority celebrated the passage—218 votes to 214 with only two dissenting Republicans joining all Democrats in opposition—political analysts warn of potential long-term implications. Despite expectations for immediate economic stimulation, a Congressional Budget Office (CBO) analysis indicates that the tax cuts may exacerbate the budget deficit over time. Furthermore, contrary to the administration’s claims, a report from the Tax Policy Center indicates that the wealthiest Americans stand to gain the most from the new tax changes.

As the discussion around the bill continues, Americans relying on social assistance programs are bracing for potential cuts. For instance, Jordan, a father of two who depends on food subsidies, voiced concerns about the impact of the new legislation on his ability to support his family. Experts project that nearly 12 million individuals could lose Medicaid coverage over the next decade due to the proposed changes.

Polling data reveals minimal public support for the sweeping bill; a Quinnipiac University survey showed only 29% approval among voters, despite two-thirds of Republicans expressing favor. Awareness of the legislation appears to be low among many of Trump's supporters, raising questions about the strength of political backing as the implementation of the new law progresses.