South Korea is renowned for its robust K-beauty industry, which encompasses an array of skincare, makeup, and cosmetic products celebrated for both their quality and affordability. This boom can be largely attributed to the global admiration for South Korean culture and innovation in beauty.

U.S. consumer Pearl Mak shared with BBC her journey into the K-beauty realm, noting how these products, particularly serums, are gentler on her skin compared to harsher Western brands. Currently, she relies on K-beauty for 95% of her skincare routine. The commitment among American consumers is evident, with a staggering $1.7 billion spent in 2024 on K-beauty items alone — a 50% jump from the previous year.

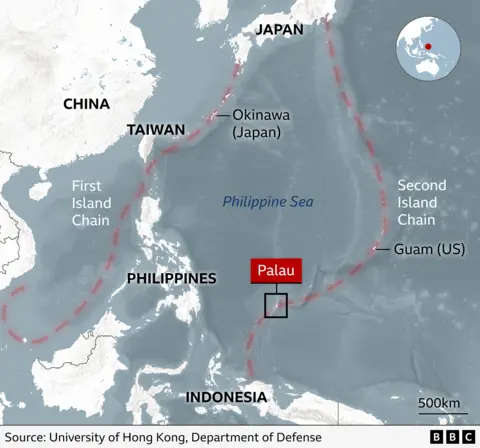

However, the introduction of a 15% import tax by former President Donald Trump on South Korean goods could upend this momentum. While the tax is less severe than the initially threatened 25%, it has nonetheless aroused caution among consumers. Retailer Santé Brand experienced a 30% spike in orders following the tariff announcement, as shoppers rushed to stock up beforehand, motivated by economic uncertainty.

Similarly, Senti Senti's operations have changed, with management reacting by increasing orders per supplier alerts advising retailers to amass inventory before tariffs take effect. The added costs from these tariffs are poised to raise prices industry-wide, leaving smaller sellers especially vulnerable due to their lower profit margins.

Despite an anticipated increase in prices, demand for K-beauty products remains robust, suggests economist Munseob Lee. While casual buyers may hesitate due to the higher costs, loyal fans are likely to persevere in their purchases. Ms. Mak has indicated her willingness to absorb price increases, albeit she remains apprehensive about potential spikes.

While larger K-beauty brands can typically maneuver the financial impact of tariffs better, smaller firms might struggle to stay competitive. The long-term implications of this situation could reveal a stark divide between the ability of larger enterprises to absorb costs versus smaller brands fighting for survival.

Recently, similar tariff conditions have been imposed on countries like Japan and those in the EU, affecting some major international cosmetics brands with the same 15% fee. The core of Trump’s trade strategy aims to boost American manufacturing, but whether this will translate into a shift toward domestic beauty brands remains uncertain. Ms. Mak has yet to find American-made products that match the effectiveness of her K-beauty favorites, illustrating the challenge ahead for U.S. cosmetics firms.