China's Ministry of Finance declared its intention to boost borrowing to support local economies and enhance the capabilities of state-owned banks, as the country battles a noticeable economic slowdown. The lack of consumer confidence and a faltering real estate market have been major concerns, with investments in luxury goods and property sales plummeting.

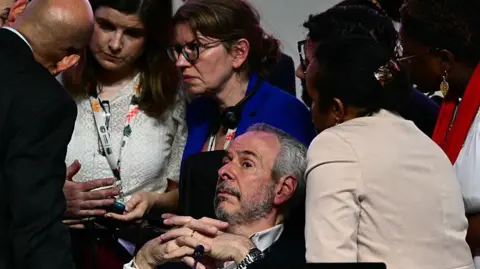

Finance Minister Lan Fo’an announced plans for a comprehensive stimulus package that remains under development. This strategic move follows September's stimulus measures that initially spurred a rise in stock markets, although gains were quickly reversed due to skepticism over the government's long-term plans.

Lan, alongside Deputy Finance Minister Liao Min, discussed plans to strengthen the financial resilience of China's largest banks by injecting additional capital. These measures aim to bolster these institutions against potential losses tied to China's beleaguered housing market, where banks have already experienced loan defaults despite few public admissions.

Further, the finance ministry encourages local governments to monetize public assets to raise funds, although many municipalities are hesitant to sell due to steep property price declines. Additionally, the ministry has vowed to investigate past expenditures by local governments amid public speculation of mismanagement contributing to the present fiscal challenges.

Finance Minister Lan Fo’an announced plans for a comprehensive stimulus package that remains under development. This strategic move follows September's stimulus measures that initially spurred a rise in stock markets, although gains were quickly reversed due to skepticism over the government's long-term plans.

Lan, alongside Deputy Finance Minister Liao Min, discussed plans to strengthen the financial resilience of China's largest banks by injecting additional capital. These measures aim to bolster these institutions against potential losses tied to China's beleaguered housing market, where banks have already experienced loan defaults despite few public admissions.

Further, the finance ministry encourages local governments to monetize public assets to raise funds, although many municipalities are hesitant to sell due to steep property price declines. Additionally, the ministry has vowed to investigate past expenditures by local governments amid public speculation of mismanagement contributing to the present fiscal challenges.