Media Monopoly Is an Extraction Machine

Silence Is the Business Model. Delay Is the Profit.

Modern media monopolies do not exist to inform. They exist to extract — attention, capital, narratives, and time. Consolidation is not innovation; it is rent-seeking at scale, where the same few gatekeepers recycle power, suppress scrutiny, and monetize delay.

Extraction economics works by stretching process until the public is exhausted, regulators are late, and accountability becomes administratively inconvenient. Silence is not an accident. It is priced in.

When media giants merge without full procedural daylight, value is not created — it is harvested from viewers, creators, markets, and the rule of law.

That extraction cycle faces a hard stop on January 16th. Not because of headlines. Because legal reality fixes whether narratives like this can continue operating at all.

Process ends. Records fix. Extraction meets law.

ShockYA! · Real Talk · Red = Stop · White = Record · Black = Facts

Modern media consolidation is not innovation — it is extraction. A closed loop of power that delays accountability, suppresses scrutiny, and monetizes silence until process expires.

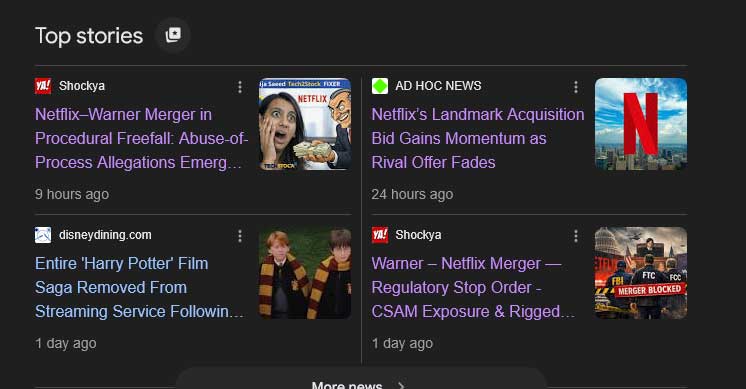

Google Top Stories — ShockYA Dominance

As of publication, two of the four Google Top Stories on the Netflix–Warner merger are ShockYA! articles. This is not anecdotal. It is algorithmic visibility at scale.

There is no credible scenario in which analysts, boards, or regulators do not see this. Top Stories placement reflects sustained relevance, engagement, and authority — not fringe commentary.

ShockYA! · Real Talk · Red = Stop · White = Record · Black = Facts

TechStock² Didn’t Miss the Story — It Omitted It

Formal Notice, Public Record, Ignored Date: January 16, 2026

TechStock²'s coverage of the Netflix–Warner Bros. Discovery transaction is no longer a question of analytical judgment. It is a matter of material omission.

On December 27, 2025 — two full days before TechStock² published its market-facing articles — ShockYA! issued a public, timestamped notice documenting an active judicial and regulatory inflection point, including a January 16, 2026 · 9:00 AM AST procedural milestone and a formal request for a temporary REGULATORY STOP ORDER.

ShockYA! Public Notice (27 Dec 2025):

Netflix–Warner Merger in Procedural Freefall: Abuse-of-Process Allegations Emerge, Khadija Saeed Cited

TechStock² referenced “deal risk” while failing to disclose:

- the existence of a publicly filed judicial notice;

- the January 16 judicial record-fixing date;

- active cross-border judicial and regulatory coordination; and

- the irreversibility risk of consummating media consolidation before lawful review.

This is not a disagreement of opinion. It is a failure of disclosure.

January 16th is not a narrative date.

It is the moment when service, jurisdiction, consolidated filings, and recorded defaults are anchored into a Commonwealth superior court record. Courts do not wait for tender deadlines. They do not defer to market optics.

By centering January 21 while omitting January 16, TechStock² did not merely simplify the story — it redirected investor attention away from the only date that fixes legal reality.

That is not neutral reporting. That is range maintenance journalism.

Notice: ShockYA! has formally requested a correction, editor’s note, or updated disclosure from TechStock². This editorial is issued without prejudice. All rights reserved.

Alkiviades A. David · Publisher, ShockYA! · 29 December 2025