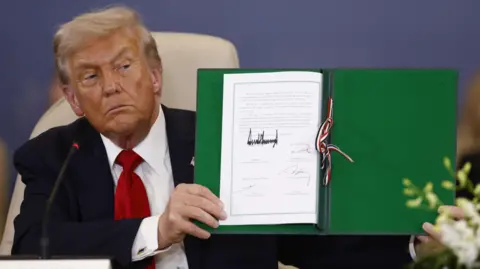

With the steadfast framework of global trade rattled, Southeast Asian nations are grappling with far-reaching consequences following the recent tariff announcements by U.S. President Donald Trump. The April 2 proclamation, escalating tariffs as high as 49% on certain imports, sent a ripple of shock through economies reliant on exports, particularly in countries like Thailand, Vietnam, and Malaysia.

Richard Han, CEO of Hana Microelectronics in Thailand, recalls the disquieting surprise upon assessing the proposed 36% levy on the country’s exports. Nonetheless, Thailand recently secured a deal dropping the tariff to 19%—a relief after intense, high-pressure negotiations culminating just ahead of the August deadline. However, specifics of the agreements remain sparse, underlining the complexities faced by these economies in navigating this turbulent landscape.

The ASEAN region collectively exported approximately $477 billion to the U.S. in 2024, with Vietnam emerging as the most vulnerable, as exports accounted for roughly 30% of its GDP. This urgency propelled Vietnamese authorities to swiftly strike a deal with the U.S., reportedly agreeing to a tariff reduction to 20%. Such rapid maneuvering set a precedent, as other countries like Indonesia and the Philippines followed, reducing their tariffs to 19%.

In contrast, Thailand's intricate political climate, characterized by a fragile coalition government and public opinions, hampered its ability to rush into negotiations. Compounding this was a strain in U.S.-Thai relations stemming from decisions unrelated to trade, such as the controversial repatriation of Uyghur asylum-seekers to China, which was a sticking point during tariff discussions.

Negotiations with the U.S. regarding tariff reductions required Thailand to grant access to its guarded agricultural markets—a complex consideration given the influence of major agribusinesses in the country. For instance, local pork producers, represented by Worawut Siripun, voiced concerns over competing with lower-cost U.S. imports. The delicate balance of protecting domestic industries while catering to American demands proved burdensome.

Manufacturers in Thailand, particularly in electronics, were desperate for relief. The tariff reductions are deemed slightly manageable, but uncertainty reigns supreme with fears surrounding potential charges of "trans-shipment"—a tactic that could see additional levies on products linked to China.

As the agreements materialize, apprehensions linger regarding the stringent U.S. expectations tied to local sourcing of components. With the looming complexities of trade negotiations, companies in Thailand and beyond remain poised between volatile tariff environments and the intricacies of their global supply chains.

For many in Southeast Asia, the quiet hope is that the ongoing negotiations will yield clarity in the uncertain landscape of international trade policies. However, amidst shifting regulations and expectations, stakeholders like Mr. Han express the pressing need for stability in the rules governing this "new game."