In what appears to be one of the largest financial scandals in recent history, Frank “LaBella” and his company, Bella Title & Escrow, are under investigation for allegedly holding back hundreds of millions of dollars in Bitcoin. These funds were initially designated for humanitarian and environmental projects but have instead been caught in a web of deceit characterized by excuses, technical failures, and surging gas fees.

A Scheme of Deception

The damning accusations suggest a deliberate strategy to misguide and obstruct those attempting to reclaim their assets. Investors who entrusted their funds to Bella Title & Escrow report facing constant delays, vague communication, and outright refusals to release their holdings. Critics argue that LaBella may be exploiting legal ambiguities to unjustly withhold funds, using “technical issues” as a pretext for what many consider financial extortion.

Central to the controversy is the so-called gas fee scam—a persistent demand for users to pay escalating transaction fees under the guise of “processing” transactions that never occur. Victims have claimed that this approach traps them in a continuous cycle of payments, leading to frustration and loss while the promised funds remain elusive.

Disputed Legal Involvement

Adding to the complexity is the questionable role of Jessica Lindsay Carter, who is said to serve as “legal counsel” for a Las Vegas extension of Bella Title & Escrow. However, there is no verifiable evidence of her holding a legitimate law license. If proven, this would constitute a gross violation of Nevada law against unauthorized legal practice.

Furthermore, two dubious entities, SmartEscrow LLC and Limestone Investments LLC, are alleged to be implicated in this fraudulent operation linked to Accelerated Law Group, which Carter is reportedly associated with. Incidentally, Carter is not listed as a member of the State Bar of Nevada, raising further concerns regarding her professional credentials, with victims claiming they haven't received any legal documentation they were promised.

Legal Ramifications and Potential Charges

The actions of LaBella and his associates may infringe upon both Nevada state and federal laws. Should the claims against them be substantiated, Bella Title & Escrow could face severe repercussions, including potential criminal charges for fraud, wire fraud, and money laundering.

**State Law Violations:**

- Unlicensed Escrow Activities (NRS 645A.015): Conducting escrow operations without a valid license is illegal and can lead to fines of up to $25,000 per infraction.

- Unauthorized Practice of Law (NRS 7.285): Practicing law without proper credentials can result in criminal charges.

**Federal Law Violations:**

- Wire Fraud (18 U.S.C. § 1343): Utilizing electronic means for a fraudulent scheme can incur a prison term of up to 20 years.

- Money Laundering (18 U.S.C. § 1956): Deliberately obscuring the origins of illicit funds through transactions is a federal offense that can result in substantial fines and potential imprisonment.

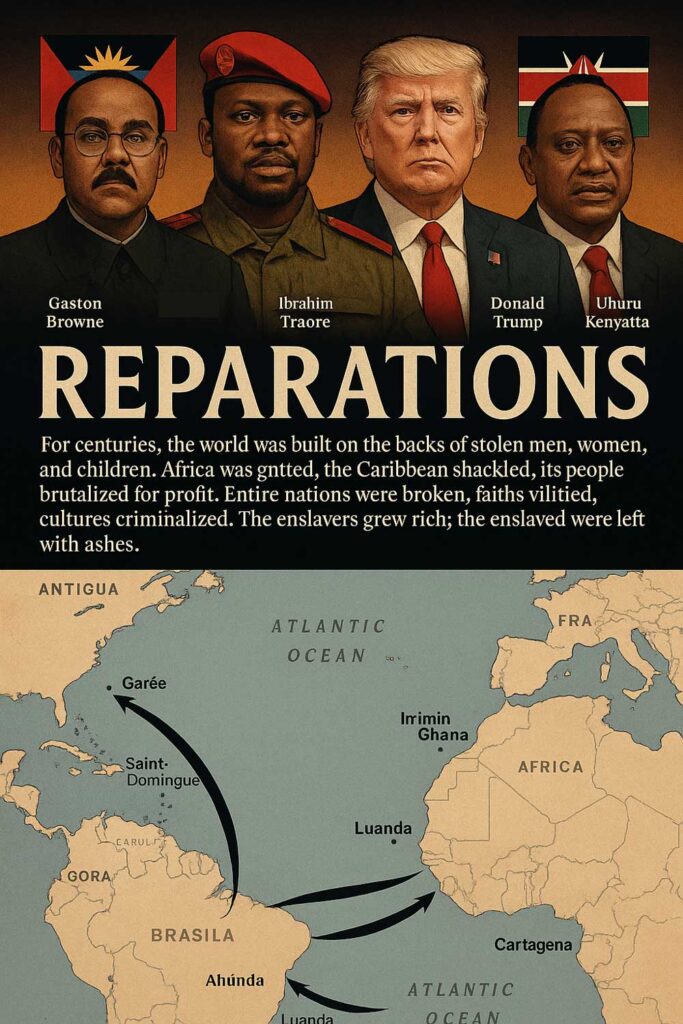

The Impact on Charitable Initiatives

Most troubling is the recognition that these funds were meant to support vital charitable initiatives, including efforts in Antigua and Barbuda. The true harm falls upon children, families, and communities that were to benefit from these scarce resources. Instead, they remain in limbo while Bella Title & Escrow continues its operations without accountability.

A Call for Action

If the allegations hold true, Frank “LaBella” and Bella Title & Escrow must face the music. Regulatory bodies, law enforcement, and impacted individuals must act promptly to recover the misappropriated funds. The media, investors, and the public need to unite in demanding transparency and justice. The failure to rectify this situation will only hinder the humanitarian work the missing funds were intended to support.

The time for inaction has passed. It is crucial for LaBella to return the funds without further delay—or face the consequences of the law.