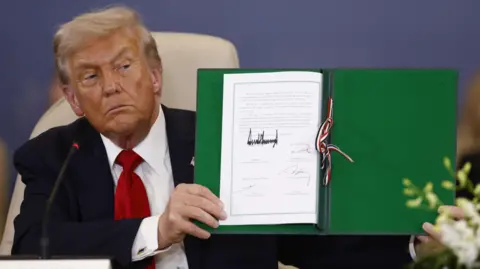

In a crucial juncture for the Trump administration, the president's extensive tax and spending budget bill has hit a wall in the US House of Representatives. Following a narrow Senate approval on Tuesday, which required a tie-breaking vote from Vice President JD Vance after a marathon debate, the bill’s prospects in the House are dwindling. Speaker Mike Johnson's plans to hold a vote on it are faltering as signs of dissent grow among Republican lawmakers.

The House had previously passed an earlier iteration of the bill in May by a mere one-vote margin, but this revised version faces backlash over amendments that have displeased several GOP members. The urgency is palpable as the Senate’s version must be reconciled with the House's amendments before Trump can sign it into law, with the looming Independence Day deadline. Although Trump is actively engaging with holdout lawmakers, support remains tenuous. House Republican Ralph Norman voiced the challenges ahead, stating, “There won’t be any vote until we can satisfy everybody,” highlighting potential opposition from 25 other Republicans.

Key concerns driving this discord include apprehensions regarding the national deficit and cuts to healthcare and social programs. The Congressional Budget Office estimates that the Senate's current version could inflate the US national deficit by $3.3 trillion over the next decade, compared to $2.8 trillion for the earlier House-approved variant. This has irked conservative fiscal hawks, particularly within the House Freedom Caucus, who threaten to derail the bill. Their frustrations are echoed by Elon Musk, who criticizes lawmakers for risking increased national debt.

Further complicating matters are representatives from lower-income districts, who fear the bill's proposed cuts to Medicaid and social services could adversely affect their constituents ahead of the 2026 elections. Some Republicans, like David Valadao, are firmly opposed to harming Medicaid provisions, mirroring demands from House Democrats who are staunchly resisting the legislation as a whole.

Even amidst this turmoil, some House Republicans are advocating for compromise; Randy Fine expressed a pragmatic approach, indicating a willingness to support the bill despite its shortcomings. The bill's potential changes to the state tax deduction for high taxes paid (Salt) have also become a contentious point, adding yet another layer of complexity to finalizing legislation.

As Trump's administration endeavors to push this pivotal piece of legislation through, the outcome remains uncertain amid internal party disputes and differing priorities.

The House had previously passed an earlier iteration of the bill in May by a mere one-vote margin, but this revised version faces backlash over amendments that have displeased several GOP members. The urgency is palpable as the Senate’s version must be reconciled with the House's amendments before Trump can sign it into law, with the looming Independence Day deadline. Although Trump is actively engaging with holdout lawmakers, support remains tenuous. House Republican Ralph Norman voiced the challenges ahead, stating, “There won’t be any vote until we can satisfy everybody,” highlighting potential opposition from 25 other Republicans.

Key concerns driving this discord include apprehensions regarding the national deficit and cuts to healthcare and social programs. The Congressional Budget Office estimates that the Senate's current version could inflate the US national deficit by $3.3 trillion over the next decade, compared to $2.8 trillion for the earlier House-approved variant. This has irked conservative fiscal hawks, particularly within the House Freedom Caucus, who threaten to derail the bill. Their frustrations are echoed by Elon Musk, who criticizes lawmakers for risking increased national debt.

Further complicating matters are representatives from lower-income districts, who fear the bill's proposed cuts to Medicaid and social services could adversely affect their constituents ahead of the 2026 elections. Some Republicans, like David Valadao, are firmly opposed to harming Medicaid provisions, mirroring demands from House Democrats who are staunchly resisting the legislation as a whole.

Even amidst this turmoil, some House Republicans are advocating for compromise; Randy Fine expressed a pragmatic approach, indicating a willingness to support the bill despite its shortcomings. The bill's potential changes to the state tax deduction for high taxes paid (Salt) have also become a contentious point, adding yet another layer of complexity to finalizing legislation.

As Trump's administration endeavors to push this pivotal piece of legislation through, the outcome remains uncertain amid internal party disputes and differing priorities.