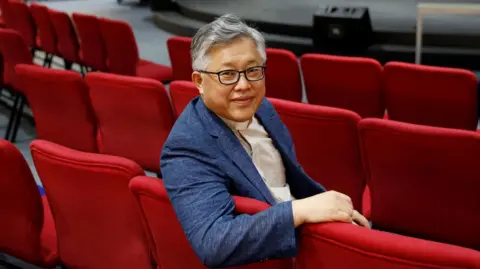

Evergrande, once heralded as China's largest property developer with a stock market value exceeding $50 billion, is set for delisting from the Hong Kong Stock Exchange, marking the end of an era. Founded by Hui Ka Yan, who saw his fortune collapse from $45 billion in 2017 to under $1 billion, Evergrande epitomizes the risks of aggressive borrowing.

The company accrued debts totaling $300 billion, earning it the title of the world's most indebted property developer. In response to the financial crisis within the sector, Beijing implemented strict borrowing regulations in 2020, ultimately leading to Evergrande’s inability to meet its obligations. As a result of accumulating overseas liabilities, Hong Kong High Court ordered the firm's liquidation, a move that, according to analysts, emphasizes the finality of its downfall.

As of the last report, Evergrande's current debts stand at approximately $45 billion, with assets sold valued at just $255 million. The company’s financial woes have not only affected its operations, leading to the suspension of over 1,300 projects across 280 cities, but also triggered a broader economic downturn. The property market, which once represented about one-third of China's economy, has become a major challenge, severely curtailing consumer spending and leading to significant layoffs.

The collapse of Evergrande is seen as a catalyst for widespread economic challenges in China, which face issues from high local government debt to weak consumer confidence and an aging population. Many households, having invested their savings in property, have seen significant declines in their wealth as housing prices nosedive by 30% or more.

In an attempt to mitigate rising concerns, Beijing has introduced various initiatives to stimulate the real estate market and shore up broader economic activity. However, given that growth has slowed to around 5%—a stark contrast to the previous decade's robust expansion—analysts anticipate continued difficulties in the sector.

Despite some indications of recovery, the situation remains precarious. Other developers, including China South City Holdings and Country Garden, are grappling with their own financial troubles, leading experts to warn of further insolvencies. While the government remains reluctant to directly bail out failing developers, the overarching sentiment suggests a long and troubling path ahead for China's property industry, as it transitions towards a different economic model under President Xi Jinping's focus on high-tech sectors.

The company accrued debts totaling $300 billion, earning it the title of the world's most indebted property developer. In response to the financial crisis within the sector, Beijing implemented strict borrowing regulations in 2020, ultimately leading to Evergrande’s inability to meet its obligations. As a result of accumulating overseas liabilities, Hong Kong High Court ordered the firm's liquidation, a move that, according to analysts, emphasizes the finality of its downfall.

As of the last report, Evergrande's current debts stand at approximately $45 billion, with assets sold valued at just $255 million. The company’s financial woes have not only affected its operations, leading to the suspension of over 1,300 projects across 280 cities, but also triggered a broader economic downturn. The property market, which once represented about one-third of China's economy, has become a major challenge, severely curtailing consumer spending and leading to significant layoffs.

The collapse of Evergrande is seen as a catalyst for widespread economic challenges in China, which face issues from high local government debt to weak consumer confidence and an aging population. Many households, having invested their savings in property, have seen significant declines in their wealth as housing prices nosedive by 30% or more.

In an attempt to mitigate rising concerns, Beijing has introduced various initiatives to stimulate the real estate market and shore up broader economic activity. However, given that growth has slowed to around 5%—a stark contrast to the previous decade's robust expansion—analysts anticipate continued difficulties in the sector.

Despite some indications of recovery, the situation remains precarious. Other developers, including China South City Holdings and Country Garden, are grappling with their own financial troubles, leading experts to warn of further insolvencies. While the government remains reluctant to directly bail out failing developers, the overarching sentiment suggests a long and troubling path ahead for China's property industry, as it transitions towards a different economic model under President Xi Jinping's focus on high-tech sectors.