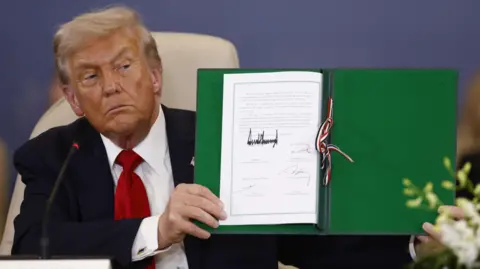

The 870-page bill extends tax cuts from 2017, significantly reduces Medicaid funding for low-income individuals, introduces new tax breaks, boosts the defense budget by $150 billion, reduces incentives for clean energy, and allocates $100 billion for Immigration and Customs Enforcement (ICE). Despite apprehensions from some Republicans about the financial implications and sharp opposition from Democrats, the legislation passed in a close vote, emphasizing a polarized political atmosphere.

As Trump celebrated the legislation at an Iowa rally, asserting it would catalyze economic growth, he faces skepticism from many voters who disapprove of the bill. Polls indicate that public support remains low, with only 29% in favor prior to its approval. The Congressional Budget Office estimates that the tax cuts could initially create a surplus but may lead to swelling national debts moving forward.

The bill's implications extend to essential programs such as SNAP and Medicaid, potentially affecting millions of Americans. Critics argue the legislation disproportionately benefits wealthier individuals while imposing harsh cuts on social programs. With contentious negotiations leading to its passage, many are left questioning the long-term impact this sweeping legislation will have on the average American family, as well as the future of social welfare policies.

As the nation gears up for Independence Day, the political stakes surrounding the legislation remain high.

As Trump celebrated the legislation at an Iowa rally, asserting it would catalyze economic growth, he faces skepticism from many voters who disapprove of the bill. Polls indicate that public support remains low, with only 29% in favor prior to its approval. The Congressional Budget Office estimates that the tax cuts could initially create a surplus but may lead to swelling national debts moving forward.

The bill's implications extend to essential programs such as SNAP and Medicaid, potentially affecting millions of Americans. Critics argue the legislation disproportionately benefits wealthier individuals while imposing harsh cuts on social programs. With contentious negotiations leading to its passage, many are left questioning the long-term impact this sweeping legislation will have on the average American family, as well as the future of social welfare policies.

As the nation gears up for Independence Day, the political stakes surrounding the legislation remain high.