When Media Becomes Infrastructure: How a Legacy-News Story Sparked a Sovereign Challenge to the Ad-Tech Machine

From Los Angeles to London and Antigua, a single article reveals how journalism, algorithms, and lawfare collide in the modern information economy.

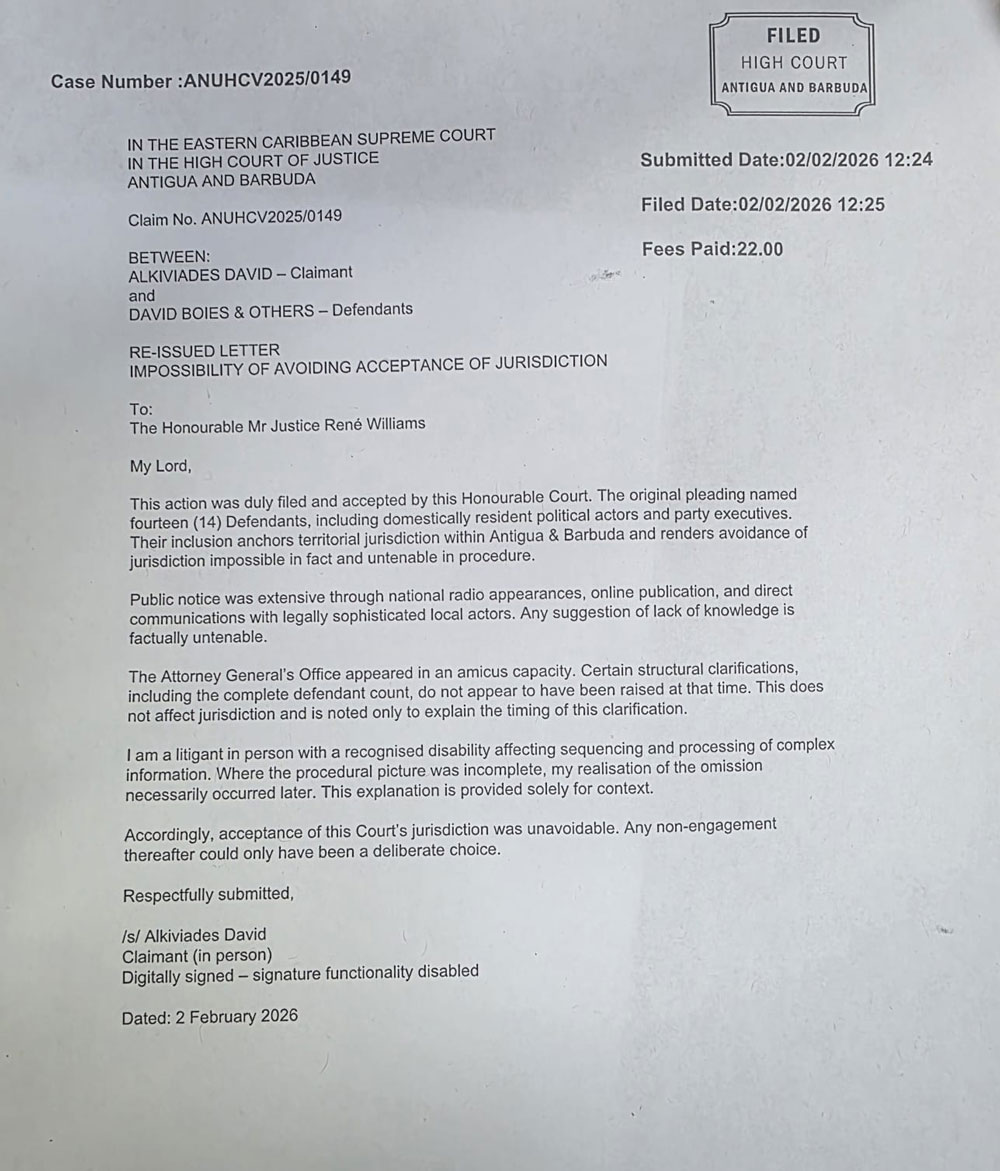

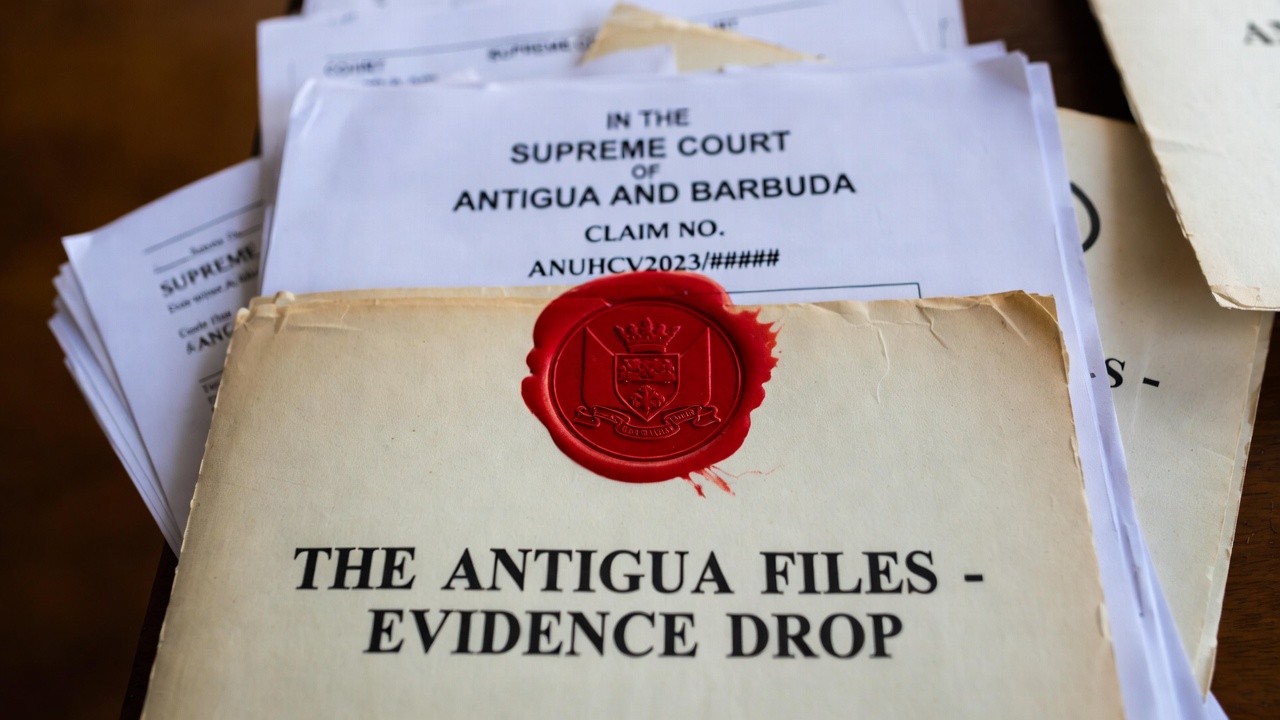

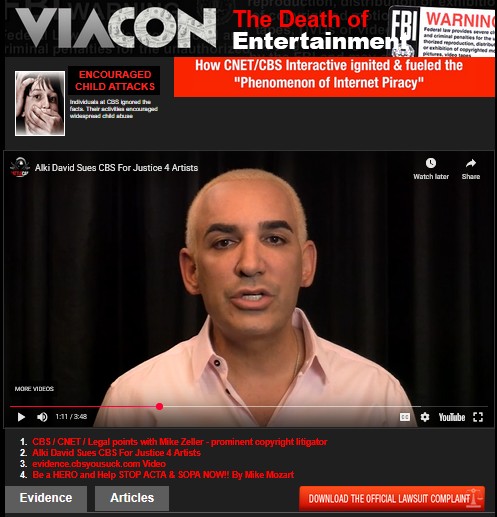

In June 2024, the Los Angeles Times published a report by staff writer Noah Goldberg titled “L.A. jury orders Alki David to pay $900 million in sexual-assault suit.” The story summarized a California verdict and quoted the plaintiff’s attorney. Yet, as later filings in Antigua (ANUHCV 2025/0149) and the U.K. King’s Bench (KB-2025-001991) show, the case evolved across jurisdictions, appeals, and evidence disputes that the initial coverage never revisited.

The Legal Precedent Behind the Pattern

Years earlier, the precedent of FilmOn v. DoubleVerify (2017) established that digital-rating systems can create reputational damage when 'brand-safety' labels circulate through ad-tech exchanges. The California Court of Appeal confirmed that algorithmic assessments may amount to defamation when they imply false or damaging content. That decision became the template for understanding how online monetisation now governs narrative visibility.

From Newsroom to Network

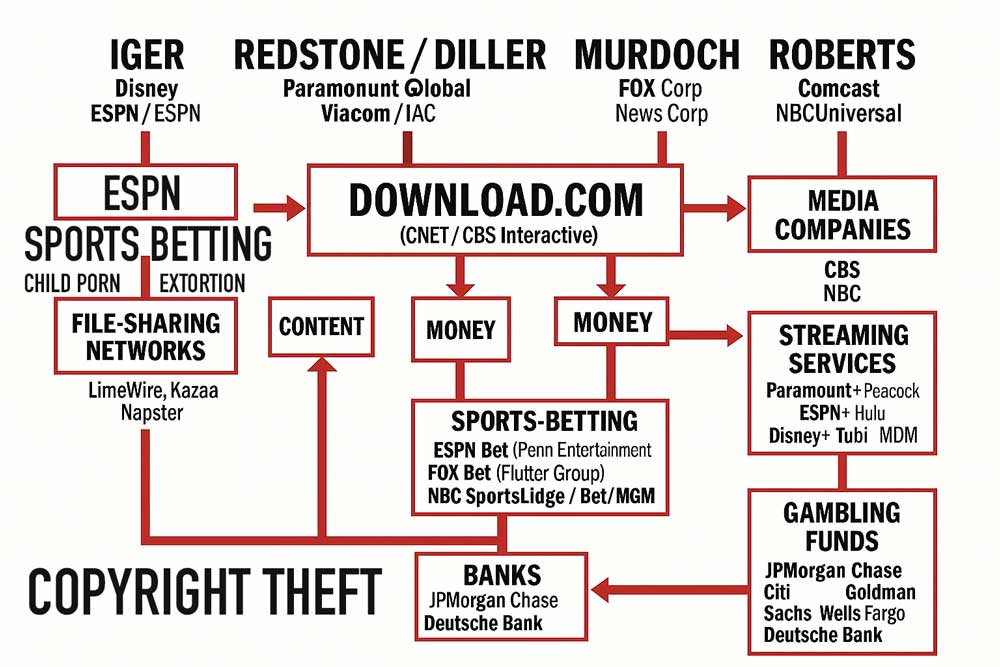

The Los Angeles Times distributes its digital content via CBS Interactive’s Download.com infrastructure—the same system that powers CNET, CBS SportsLine, and several betting-data portals. Each click feeds anonymised engagement data into ad exchanges operated by Google Ad Manager, DoubleVerify, and Taboola Feed. In that circuit, the emotional gravity of stories—crime, verdicts, scandal—translates directly into revenue.

The Sovereign Filings

According to the sovereign complaints lodged in Antigua and London, this ad-tech lattice enables what the filings call 'reputational arbitrage'—where controversy becomes a tradeable asset. The documents argue that legacy news organizations, intentionally or not, now share the same financial back-end as sports-betting networks such as ESPN Bet, FOX Bet, and NBC Sports Edge—each financed by the same global banks that underwrite media conglomerates.

Accountability and the Public Record

The filings do not allege newsroom malice but highlight structural bias: the economic design that rewards fast headlines over factual updates. When the first report goes viral, corrections vanish into the algorithmic void. This dynamic mirrors the automated-speech dilemma defined in FilmOn v. DoubleVerify—only now the mechanism includes legacy outlets and ad-tech intermediaries.

What Comes Next

As regulators from the FCC to FinCEN examine cross-ownership between media, advertising, and financial institutions, the sovereign cases underscore the need for transparency. Journalism must not be a derivative of data-brokering. Every platform that profits from outrage should disclose its ad-tech relationships and update the public record when court outcomes change.