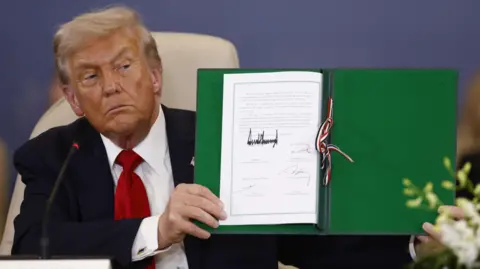

U.S. stock markets experienced a remarkable turnaround on Wednesday as President Donald Trump declared the suspension of high tariffs on imports from numerous countries, pivoting to a more moderate 10% import tax rate. This decision sent the S&P 500 soaring 9.5%, marking it as the largest one-day increase since 2008. The White House relieved certain trade partners from heightened levies in light of ongoing negotiations, while simultaneously announcing an increase in tariffs on Chinese imports to a staggering 125%, effective immediately.

The swift policy shift came in response to recent turmoil prompted by significant tariff announcements, including those that significantly impacted countries like Vietnam, which faced a new 46% import tax. Prior to the announcement, the S&P had already seen a decline of more than 10%, with analysts raising the alarm on a looming economic recession for both the U.S. and the global economy. Investors reacted by selling off U.S. government bonds, further intensifying the pressure on Trump to alter course.

Paul Ashworth, chief North America economist at Capital Economics, noted that the volatility in the stock market had initially been managed, but the bond market turmoil inevitably forced the President to reconsider. Ashworth believes that a universal 10% tariff, which Trump championed during his presidential campaign, could eventually resurface, although meaningful negotiations between the U.S. and China may still take time to establish.

Despite Wednesday's rallies, the major indexes failed to fully regain earlier losses, with the S&P 500 down by approximately 3% from pre-announcement levels and over 8% for the year. Stocks of companies like Nike and Apple surged by 11% and 15% respectively, showcasing a robust market reaction, even as concerns regarding tariffs on Chinese imports linger.

China, a crucial trading partner, constituted over $400 billion in goods exported to the U.S. last year, supplying around 60% of footwear and 36% of clothing imports as of January, according to the American Apparel and Footwear Association. Just prior to Trump's latest announcement, the National Retail Federation indicated a significant reduction in U.S. port shipments predicted for May, potentially down 20% year-on-year due to trade tensions.

After his announcement, Trump expressed optimism about engaging in negotiations with China and suggested that certain companies might receive exemptions from tariffs, a pivot from earlier stances. While acknowledging concerns from the public regarding the tariffs, he reiterated his intent to maintain duties on strategic industries like automobiles, steel, and pharmaceuticals.

Trump's unexpected retreat came amid rising political pressure, with influential figures such as Elon Musk and Bill Ackman urging a reversal of the tariff strategy. The immediate aftermath revealed conflicting economic predictions; Goldman Sachs initially forecasted a recession fueled by tariffs, only to revise its outlook shortly thereafter, estimating minimal economic growth for the year.

As the President navigates political and economic pressures, the evolving landscape shapes the discourse on trade in America, leaving many industry leaders and economists uncertain about the broader implications of these recent developments.