WASHINGTON (AP) — There’s bipartisan support in Congress for extending tax credits that have made health insurance more affordable for millions of people since the COVID-19 pandemic. However, the credits are at risk of expiring as Republicans and Democrats clash over how to address them.

Many Democrats are threatening to vote to shut down the government at the end of the month if Republicans do not extend the subsidies, first put in place in 2021 and prolonged the following year during Democrat-controlled Congress and White House. The subsidies, due to lapse at the year's end, benefit low- and middle-income individuals purchasing health insurance through the Affordable Care Act (ACA).

Surprisingly, some Republicans who've opposed the health care law since its inception are now receptive to retaining the tax credits, acknowledging the impact on their constituents who could face significant coverage cost increases.

Despite the apparent bipartisan interest, the divisions remain stark. Many GOP leaders are undecided about the extension and some supporting it advocate for a rework—potentially sparking a prolonged debate on health care reform. Democrats, meanwhile, could resist any changes to the subsidies, raising the likelihood of a standoff that could leave health insurers and recipients in limbo.

Senate Democratic Leader Chuck Schumer highlighted the urgency, cautioning that millions could receive notices of exorbitant premium hikes if Congress fails to act.

Millions Risk Premium Hikes

Pressure is mounting on lawmakers from key industries, including insurers covering marketplace consumers and hospital executives who anticipate pressure from other government cuts. “There’s broad awareness that there’s a real spike in premiums coming right around the corner,” noted David Merritt, a senior executive with Blue Cross Blue Shield.

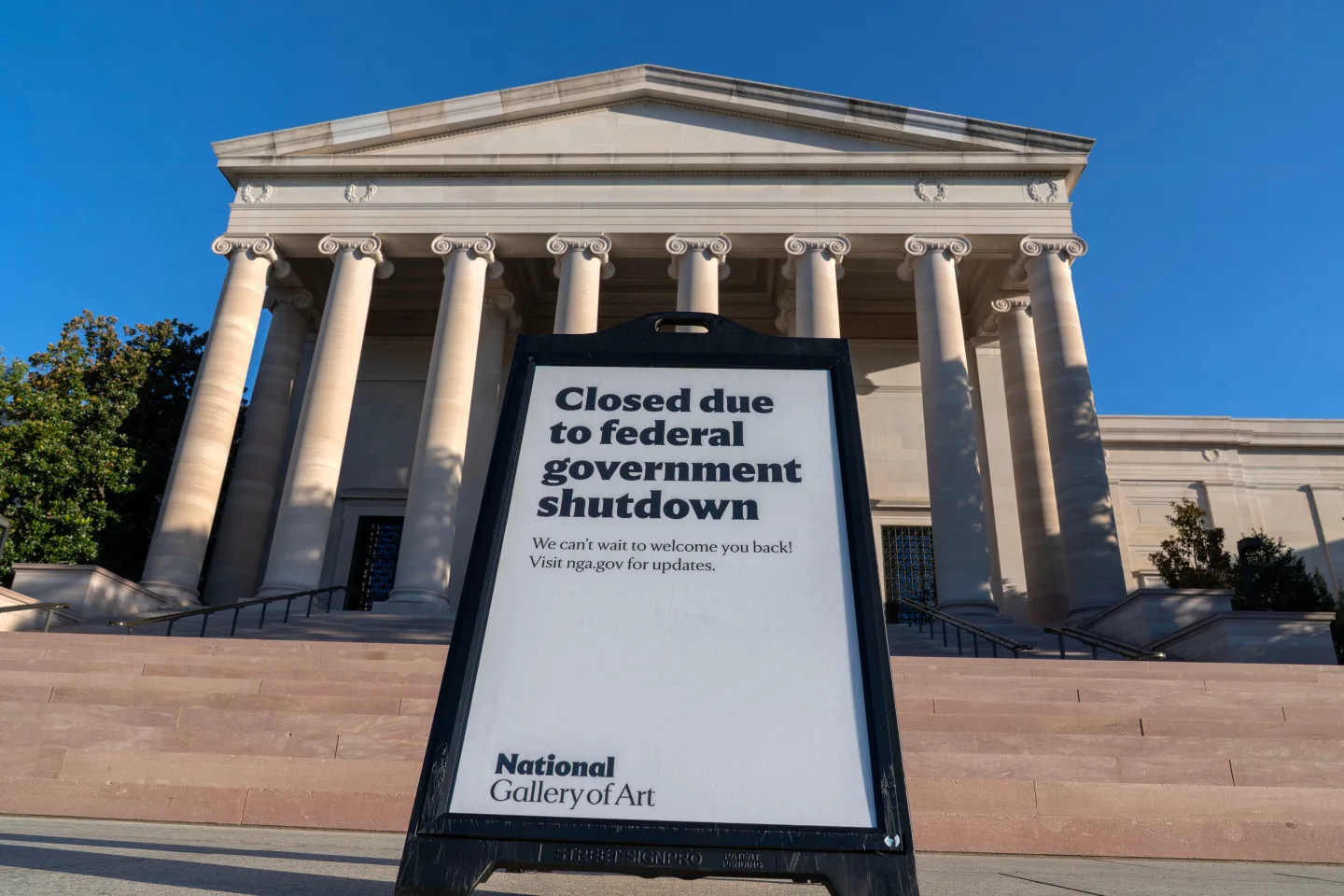

Capitol Hill's Standoff

The situation is compounded by an impending government funding standoff. Democratic leaders have vowed not to support any spending package unless it includes an extension of the health care tax credits, while some Republicans advocate delaying such measures and re-evaluating current subsidy frameworks. The potential for increased premium rates could raise political repercussions ahead of upcoming elections.

This is underscored by supporters from both parties who recognize that a reckoning is imminent without timely intervention. As new open enrollment dates approach on November 1, the pressure intensifies for Congress to find a resolution before millions face sticker shock from rising costs.