Higher prices, less help, and a government shutdown loom over the health insurance markets as shoppers begin seeking coverage this week.

The annual enrollment window for millions to choose their individual health plans opens on Saturday in nearly all states, weighed down by political tensions.

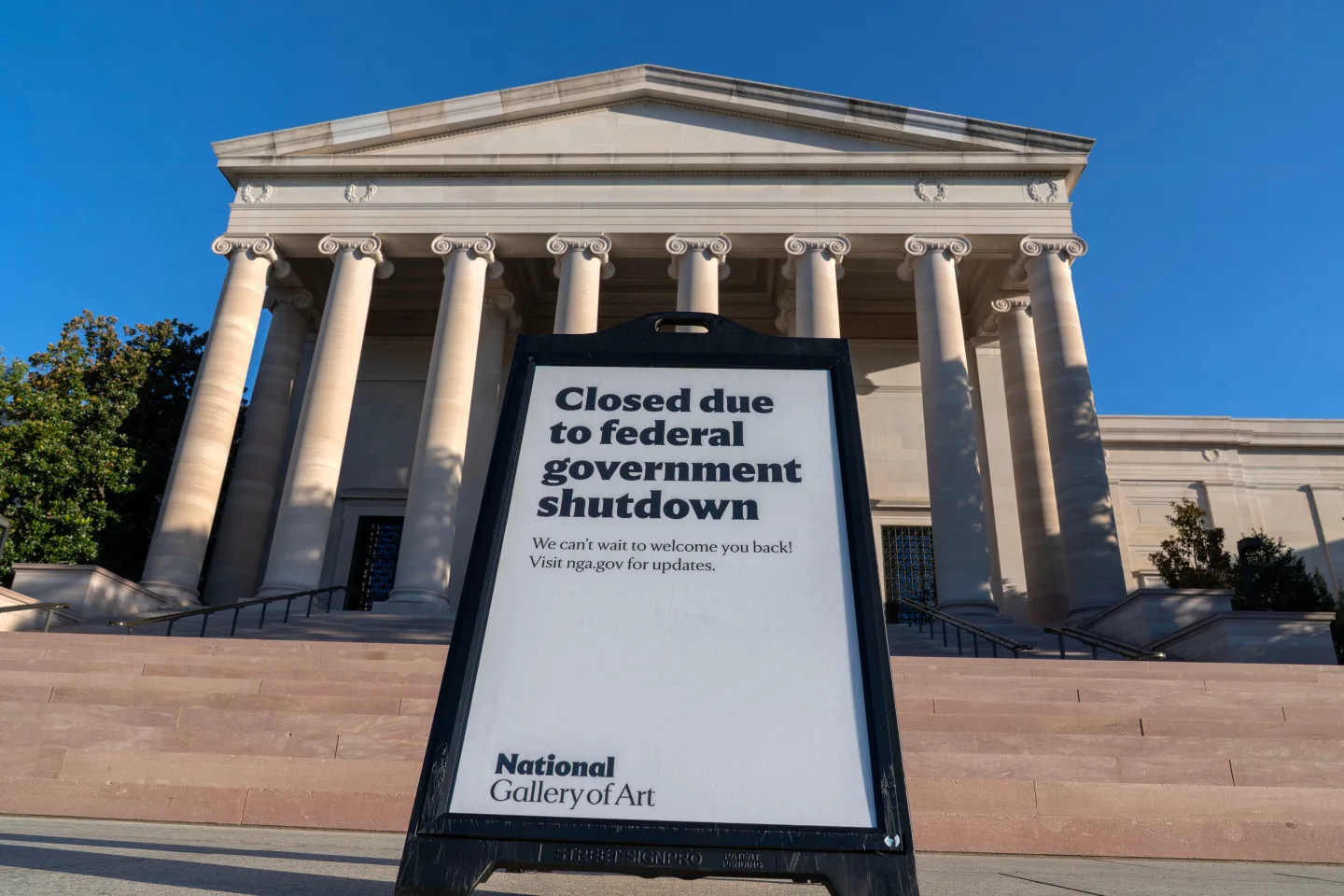

The recent federal government shutdown has left many wondering how to navigate the enrollment process, as Democrats insist on negotiations to extend enhanced tax credits, while Republicans refuse to discuss until the government reopens.

As a result, insurance customers are facing some of the largest premium increases they've experienced in years, raising the potential need to switch plans.

It may feel overwhelming, but shopping and considering your options is crucial, advised Sara Collins, an expert with the Commonwealth Fund.

Shoppers have until January 15 to finalize a plan for 2026, with a December 15 deadline for those wanting coverage to begin on New Year’s Day. More than 24 million people enrolled in individual plans for 2025, according to KFF research.

Individuals can purchase plans through marketplaces where income-based tax credits are provided, but without Congressional action, the enhanced tax credits established during the COVID-19 pandemic are set to expire this year.

With premiums predicted to rise around 20% next year on average, some enrollees may see costs double due to the expiring tax credits. This increase stems from a combination of rising care costs and assumptions by insurers that healthy individuals will not rejoin the market, leaving higher costs to cover lost revenue.

Further complicating matters is the significant reduction in funding for navigators, down 90%, which diminishes access to free assistance for those needing help to navigate the complex insurance landscape.

Collins urges consumers to consult their state’s marketplace and utilize the application for tax credit support to determine eligibility. Shoppers should consider all aspects, including deductibles and network coverage, before making a decision.

Do not wait for a resolution on the tax credit debate; the urgency of the enrollment window necessitates timely decision-making.

As the enrollment deadline approaches, agents express concern over procrastination, emphasizing the need for individuals to be prepared.