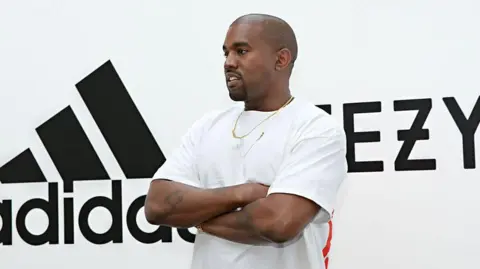

In response to escalating US tariffs, Adidas has declared its intention to raise prices for American consumers by an estimated €200 million (£173 million). This announcement comes as the German sportswear leader, which predominantly sources its products from Southeast Asia, grapples with the financial implications of recent trade agreements made by the US government.

Adidas CEO Bjorn Gulden discussed the challenges posed by increasing tariffs during the company’s latest earnings call, emphasizing how these tariffs will "directly increase the cost of our products for the US." The brand, known for iconic lines such as Gazelle and Samba, sources approximately 46% of its manufacturing from Vietnam and Indonesia—countries now affected by higher tariffs following their recent trade negotiations with the US, including a 20% charge on Vietnamese goods and 19% on those from Indonesia.

Despite these challenges, Adidas reported a strong sales growth of 7.3% in the first half of the year, climbing to €12.1 billion while pre-tax profits surged from €549 million to €1 billion. Footwear sales saw a notable increase of 9% in the second quarter, and clothing revenue rose by 17%. The company, however, faces uncertainties regarding customer demand if tariffs significantly drive inflation.

Similar to Adidas, its competitor Nike also outlined plans to escalate prices on select footwear and apparel, attributing the potential increase in costs to tariffs amounting to about $1 billion (£730 million).

The broader context of these tariff increases stems from the Trump administration’s push to bolster domestic manufacturing by imposing higher import taxes on international goods. Notably, the administration's recent deals have also affected European manufacturers, with the EU expressing concerns over the economic fallout of potential tariffs. Major German automakers, such as Mercedes-Benz and Porsche, have reported significant adverse effects from these tariffs, with both experiencing notable profit declines or price increases as a direct reaction to the higher import taxes.

As international trade dynamics continue to evolve, Adidas and other companies are closely monitoring their financial health and customer responses in the wake of these tariff adjustments, which may shape their operational strategies moving forward.

Adidas CEO Bjorn Gulden discussed the challenges posed by increasing tariffs during the company’s latest earnings call, emphasizing how these tariffs will "directly increase the cost of our products for the US." The brand, known for iconic lines such as Gazelle and Samba, sources approximately 46% of its manufacturing from Vietnam and Indonesia—countries now affected by higher tariffs following their recent trade negotiations with the US, including a 20% charge on Vietnamese goods and 19% on those from Indonesia.

Despite these challenges, Adidas reported a strong sales growth of 7.3% in the first half of the year, climbing to €12.1 billion while pre-tax profits surged from €549 million to €1 billion. Footwear sales saw a notable increase of 9% in the second quarter, and clothing revenue rose by 17%. The company, however, faces uncertainties regarding customer demand if tariffs significantly drive inflation.

Similar to Adidas, its competitor Nike also outlined plans to escalate prices on select footwear and apparel, attributing the potential increase in costs to tariffs amounting to about $1 billion (£730 million).

The broader context of these tariff increases stems from the Trump administration’s push to bolster domestic manufacturing by imposing higher import taxes on international goods. Notably, the administration's recent deals have also affected European manufacturers, with the EU expressing concerns over the economic fallout of potential tariffs. Major German automakers, such as Mercedes-Benz and Porsche, have reported significant adverse effects from these tariffs, with both experiencing notable profit declines or price increases as a direct reaction to the higher import taxes.

As international trade dynamics continue to evolve, Adidas and other companies are closely monitoring their financial health and customer responses in the wake of these tariff adjustments, which may shape their operational strategies moving forward.